IR35 is a tax legislation in the UK designed to expose ‘disguised employees’. Disguised Employees are those deemed by Her Majesty’s Revenue and Customs (HMRC) as contractors using a limited company, and if were it not for their limited company intermediary, they would otherwise be employed by their client.

IR35 means if caught, they must pay income tax and National Insurance Contributions (NICs) as if they were employed. The financial impact of IR35 is significant. It can reduce the worker’s net income by up to 25%, costing the typical limited company contractor thousands of pounds in additional income tax and NICs.

There are 900,000 one man/women Limited Companies in the UK; the *Gobal Payrol Association predicts that by 2022/2023 around £1 Billion in taxes and NIC would be lost.

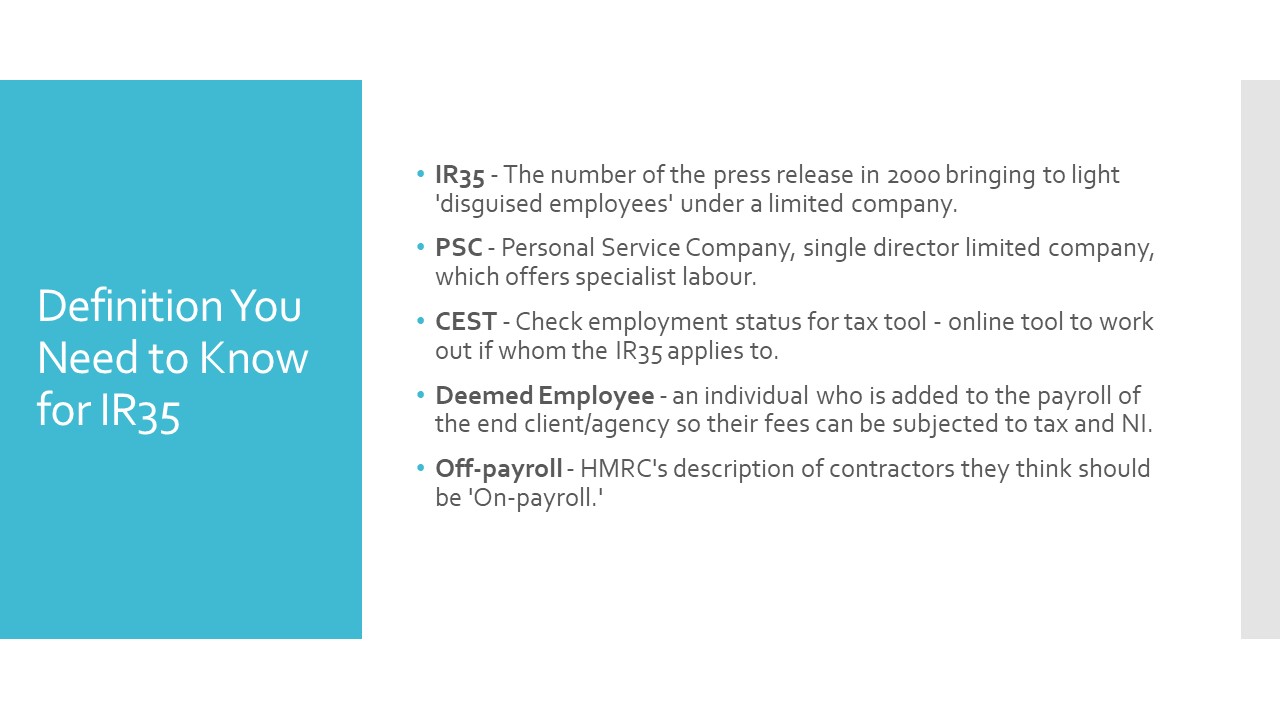

The IR35 was announced in 2000 but has been heavily criticised by tax experts and businesses as it has been seen to be poorly implemented and potentially cause stress on legitimate small businesses.

What is IR35?

IR35 is a tax law, correctly known as the Intermediaries Legislation and came into force in April 2000 as part of the Finance Act. IR35 is named after a press release published by the then Inland Revenue (now HMRC) announcing its creation.

The income tax element of the Intermediaries Legislation has subsequently been integrated into the Income Tax (Earnings and Pensions) Act 2003 (ITEPA 2003), and the NICs element into the Social Security Contributions (Intermediaries) Regulations 2000.

What to do if you feel your contractors might be affected

It is always best to seek expert advice, but there is a tool online that you can use to identify if your contractors will be affected – Check employment status for tax tool (CEST).

If you think that IR35 will apply it is essential, you communicate this with the contractor and discuss the next steps.

If IR35 does apply, then the legislation makes provision for paying that extra income tax and NICs.

For future contractors where IR35 applies it is highly advisable to have a company policy for them.

Novative offer expert HR and Payroll outsourcing for the UK. If you need to outsource any part of your processes to Novative then please contact us.

*GPA stated these figures during ‘IR35 – Are you ready?’ webinar on 13th June.